Ten Ways To Save Money On College Costs

Homework Hub is now your college hub!

10 Ways To Save Money On College Costs

While college costs are continually rising, many families search for ways to control costs while still ensuring a quality education for their child. Below, are ten ways in which families are able to reduce expenses, minimize a reduction to their retirement accounts and lower the dollar amount of loans needed to fill the gap.

As with other transitional times in life, communication amongst the family is key. Parents should communicate with their children in regards to financial expectations in the selection of a college or university and the children should be encouraged to express to their parents both their academic and social wishes for the next four years.

Please note that the list below contains some key ideas as to how to save money on the cost for college. It is not an all inclusive list and may not be right for every family. Planning strategically should start when the child is a high school sophomore or junior. But these tips below will give you some ideas for consideration as you begin to plan for this exciting time in your family’s life!

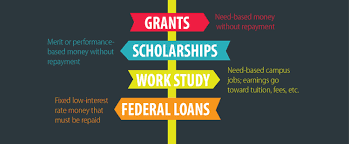

1. File both the FAFSA form and CSS Profile form early and correctly. Even if you feel that you will not qualify for need based aid, fill out the forms anyway to ensure that your child is considered for merit scholarship dollars.

2. Search for colleges in which your child will be in the top 25% of their class or, in some other fashion, positively stands above and apart from the other applicants. This will help with the acquisition of merit scholarships (even possibly from other schools through negotiations)!!

3. If considering public universities, do not only consider out of state public universities which typically come with a higher price tag. Many in state public universities provide the same academic and social opportunities with a more affordable price tag.

4. Consider the anticipated return on investment upon completion of your child’s college career. Will a top dollar school guarantee a top dollar career? Or, with your child’s intended major, will a top dollar school not make financial sense?

5. Determine if your child is able to contribute to college costs via work/study programs. These programs, while not only providing your child with work experience and a paycheck, tend to help students with time management and thus, typically lead to improved grades, improved resume and more career and graduate school opportunities.

6. Compare the cost of college books from various sources including the school bookstore, Amazon and Chegg. Consider options such as renting, purchasing used, or buying books that are only available online. Sometimes, surprisingly, the school bookstore may have the best pricing!

7. Determine if it is necessary to purchase the school’s medical insurance for your child. You may save money if your child is able to remain on your existing insurance plan.

8. If your child plans to go to graduate school, search for combination undergraduate/graduate degrees in his/her intended major where you and your child can potentially save one year of college/graduate tuition along with room and board.

9. Consider, if appropriate, your child living at home and commuting to school for at least a portion of the four years.

10. Develop a plan with your child early on. For many children, they do not graduate in four years but rather five or six. All with additional tuition and housing expense... Discuss expectations with your child so that there is minimal possibility for extension of his or her undergraduate education.

As always, communication is key. As a family, make sure to share goals, concerns and expectations. This will minimize potentially unanticipated surprises, reduce stress and keep everyone on the same page during this exciting time in your child’s life!

Ideally, the above tips will negate the possible need for student loans, but, if needed, there are ways in which to minimize costs there too!

At Homework Hub, we are here to help navigate this maze towards college!

For more information on Financial Aid form preparation, strategically planning for and applying to college to maximize merit and/or need based aid as well as finding scholarships, please contact Homework Hub at 516-423-2543 today. Homework Hub’s College Financial Coach is looking forward to working with you and your family!